The world is becoming increasingly digitized, Southeast Asia is emerging as a significant player in the adoption of disruptive technologies like Ai, Fintech and blockchain.

I heard a question from a radio show recently, someone asked, “when is Malaysia going to speed up adoption for emerging technologies?”

Doing a reality check of Malaysia’s current economic trajectory, (as of 9/10/2024), according to Bank Negara Malaysia (BNM), the Malaysian economy advanced by 5.9% in the second quarter of 2024.

However, if we are advancing based on economic percentages reporting, are we seeing any significant growth in emerging technologies adoption? To find out the answer, I did a comparison between Malaysia and Indonesia. I split my findings into four categories: blockchain adoption, Ai integration, Fintech growth and decentralization (as seen in the chart below).

Let’s dive in and take a closer look how both countries are faring in terms of Ai, blockchain and Fintech adoption.

Blockchain Adoption

Malaysia’s Blockchain Landscape

Malaysia has made significant strides in adopting blockchain technology. With government backing and regulatory frameworks in place, blockchain is being studied to be applied across various sectors, including finance, logistics, and even healthcare.

Malaysia’s Securities Commission has embraced blockchain for digital asset regulation, ensuring that innovations comply with financial laws while encouraging growth in decentralized finance (DeFi).

Malaysia’s leading and regulated crypto exchange, Luno has gained significant traction, since its debut in 2019 entering Malaysia. The company, headquartered in the UK, received approval from the Securities Commission Malaysia to operate as a Recognized Market Operator (RMO) in the country.

Searching for estimated userbase numbers, as of 2023, Luno has not publicly disclosed its exact number of customers in Malaysia. However, given its position as one of the leading cryptocurrency trading platforms, its very likely Luno has a significant user base.

However, here are three other platforms striding towards decentralization:

- MyEtherWallet (MEW): A popular Ethereum wallet and platform that allows users to interact with decentralized applications (dApps) and manage their cryptocurrencies.

- Tokenomy: A blockchain-based platform for tokenization and fundraising, enabling companies to raise capital through token sales.

- Xfers: A payment gateway and remittance platform that utilizes blockchain technology to facilitate secure and efficient transactions.

These blockchain enabled platforms are just a few examples. There are many others providing similar products and services.

Indonesia’s Blockchain Progress

Indonesia, with its booming Fintech scene, is also not far behind in blockchain adoption.

The Indonesian government has shown interest in blockchain’s potential, especially in sectors like logistics and agriculture. Blockchain is being explored as a tool to improve transparency in supply chain management and to enhance financial inclusion through cryptocurrency platforms.

Here is a list of some of the companies into it:

- Indonesian Coffee Traders Association (ICTA): The ICTA has partnered with IBM to develop a blockchain-based platform to track the origin and quality of Indonesian coffee beans.

- PT Bank Rakyat Indonesia (BRI): BRI has launched a blockchain-based platform for palm oil traceability to ensure that the oil is sourced sustainably and ethically.

- PT Telkom Indonesia: Telkom Indonesia has developed a blockchain-based platform for supply chain management in the telecommunications sector.

- PT Astra International: Astra International, one of Indonesia’s largest conglomerates, has been exploring the use of blockchain technology for supply chain management in various sectors.

In 2021, the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) regulated crypto exchanges, marking a significant leap forward for the blockchain ecosystem in Indonesia.

AI Adoption

Malaysia’s Focus on Ai

Artificial intelligence is an area where Malaysia has shown clear intent to lead. In 2021, the country launched its National Ai Roadmap, which seeks to integrate Ai into key sectors, including healthcare, finance, manufacturing, and government services.

Major initiatives like the Ai In Manufacturing (AiIM) project have helped businesses optimize operations through AI-driven insights. Moreover, Malaysia is home to several Ai start-ups and has developed robust university-led AI research programs. Here are a few of them:

- Sentient AI: A company specializing in natural language processing and machine learning.

- Inceput: An AI startup focused on computer vision and image recognition.

- Walnut AI: A company providing AI-powered solutions for customer service and sales.

- AIDA Technology: An AI startup developing solutions for the healthcare industry.

- Deepen AI: A company focused on deep learning and its applications in various fields.

One other company driving Ai innovation is Malaysia is Aerodyne. They’re leveraging Ai for advanced analytics and operational efficiency.

Indonesia’s Ai Growth

Indonesia, although lagging slightly behind Malaysia, has been making considerable progress in AI. The country is harnessing AI to improve various sectors, including retail, healthcare, and finance.

Indonesia’s government-backed AI initiatives aim to enhance public services and education, which have gained momentum due to the pandemic.

AI is also playing a critical role in Indonesia’s Fintech sector. Companies like Gojek, Indonesia’s leading super app, are using AI to improve customer experience and drive personalization.

Indonesia’s focus on AI applications in financial technology shows immense promise, particularly as it seeks to support its rapidly growing digital economy.

Fintech Growth

Malaysia’s Fintech Ecosystem

In 2023, Fintech News Network stated that there were over 300 fintech companies registered in Malaysia.

Download the report: https://fintechnews.my/malaysia-fintech-report-2023/

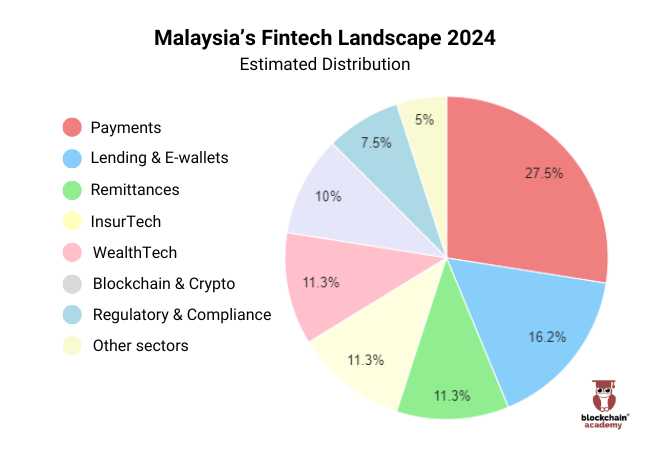

Of the 300, if we were to break it down in terms of industry and categorize them according to which industries they’re form, the pie chart below reveals:

The chart above shows the estimated distribution of the Fintech landscape in Malaysia for the year 2024. Payments is the largest segment, followed by lending and e-wallets. Remittances, insurtech, wealthtech and blockchain & crypto each make up a significant portion of the landscape. Regulatory and compliance, as well as other sectors, also play a role in the overall Fintech ecosystem in Malaysia.

Bank Negara Malaysia, has been at the forefront of developing regulatory sandboxes, enabling Fintech startups to innovate while staying compliant with financial laws. Malaysia’s Fintech ecosystem is especially strong in digital payments and Islamic Finance.

In 2023, Malaysia saw a surge in e-wallet usage, with players like Touch ‘n Go and Boost dominating the market. Being a pioneer in Islamic fintech, blending Sharia-compliant financial products with cutting-edge technology we should be in the forefront with our locally made blockchain, Ai and Fintech products penetrating globally.

Indonesia’s Fintech Boom

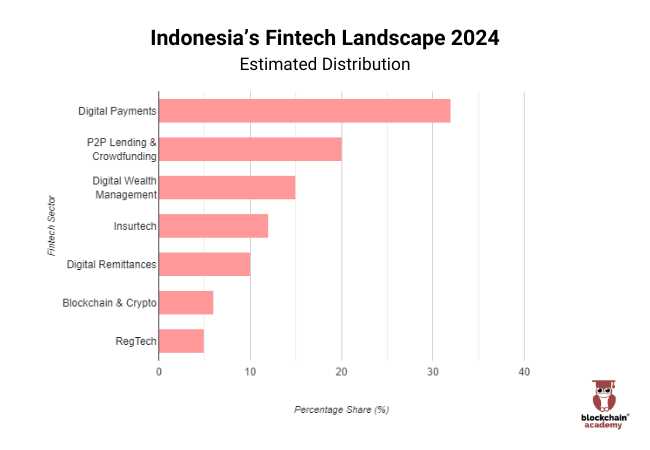

Indonesia, however, takes the lead when it comes to using blockchain, Ai and Fintech. The country’s fintech sector has experienced explosive growth, with the number of fintech players rising six-fold over the last decade.

Much of this growth has been fuelled by digital lending platforms, which have seen widespread adoption, particularly in rural areas where traditional banking services are lacking.

Fintech players in Indonesia are not just about payments; wealth management, insurance and digital remittances together with blockchain and crypto are also gaining traction.

Companies like OVO and DANA are key drivers of Indonesia’s digital payment boom, while lending platforms like Akulaku and Investree are revolutionizing access to capital for individuals and businesses alike.

Regulatory Frameworks

Malaysia’s Regulatory Environment

Malaysia’s approach to emerging technologies has been largely proactive but has slowed down in recent years.

The Securities Commission Malaysia (SC) has issued guidelines for digital assets and digital asset exchanges.

- Guidelines on Digital Assets: https://www.sc.com.my/regulation/guidelines/digital-assets

- Guidelines on Recognized Markets (RMO): https://www.sc.com.my/regulation/guidelines/recognizedmarkets/list-of-registered-digital-asset-exchanges

Bank Negara Malaysia also rolled out regulatory sandbox initiatives to foster innovation in Fintech while ensuring that consumer protection remains a priority.

Unfortunately, what is observed now is whenever there is a change in government, policies tend to change overnight too. A more stringent long-term process to lock in the policies in support of healthy governance needs to be in place.

Growth policies like these need to be in place at all times regardless who becomes Prime Minister or which party rules Parliament. Afterall, we need to consider overall continuity and growth happens for all companies that are working towards creating Ai, blockchain and Fintech solutions for Malaysians. If we can do this, I’m we can position Malaysia as the leader in innovation and emerging tech adoption.

Indonesia’s Regulatory Approach

Indonesia, on the other hand, has been more reactive in its approach. While the country has made headway in regulating fFintech and blockchain, its regulatory environment is still evolving.

However, the recent moves by BAPPEBTI to regulate crypto exchanges and Bank Indonesia’s efforts to launch a central bank digital currency (CBDC) indicate that Indonesia is becoming more forward-thinking in its approach.

Challenges in Adoption

Despite the progress, both Malaysia and Indonesia face challenges in fully embracing blockchain, AI, and fintech. For Malaysia, the main barriers are a lack of talent in these emerging fields and slow adoption among traditional industries.

However, initiatives like the National AI Roadmap and various blockchain educational programs are tackling these issues head-on.

Indonesia’s primary challenge is financial inclusion. While Fintech has made inroads, large segments of the population still lack access to digital banking services, particularly in rural areas.

Additionally, regulatory uncertainty around emerging technologies, particularly blockchain, remains an obstacle to widespread adoption.

What’s the Verdict

Indonesia has taken a slight lead, particularly in Fintech adoption. (Source: BCG)

The sheer volume of Fintech players and the rapid digitalization of financial services in the country make Indonesia a formidable force.

However, Malaysia is closing the gap, especially in blockchain and AI, where its strategic government initiatives and regulatory frameworks are laying the groundwork for future dominance.

Final Thoughts

Malaysia tends to take a more cautious approach, too cautious if I may add, which may have slowed us down compared to Indonesia.

We’ve made strides in other sectors and industries such as construction, F&B, e-hailing, etc but we’re still far off when it comes to Ai, blockchain and Fintech adoption. We’re getting there, but we could get there faster.

Is there a solution? You bet! For starters, the Malaysian government and supply chain NGO’s can take a lead and start engaging industry players in open-dialogues. They could offer them Free and paid courses for instance and help graduates be placed in blockchain, Ai and other emerging tech high paying jobs.

Too far fetched? Yea, maybe but there is no harm in being a little optimistic 🙂 What are your thoughts on this? Share them below.

- Ai, Fintech and Blockchain Adoption: Malaysia vs Indonesia - October 11, 2024

- Blockchain and AI Synergy: Future of Technology - August 22, 2024

- Blockchain Security: Threats and Best Practices - July 15, 2024